We believe responsible investment can help build a more sustainable and forward-looking global future.

Our sector-focused teams deploy capital strategically across markets worldwide.

Founded in 2001, we aim to create better jobs, environments, and opportunities for future generations.

28+

As technology connects the world and barriers fall, we’re uniquely positioned to meet our clients’ global needs.

200+

Our people power our progress—their dedication, skill, and diversity fuel OIF’s success.

Latest news, press releases & stories

OIF has created a world-class portfolio of assets globally, forming partnerships with top global institutions.

We assist you in discovering real estate solutions and insights tailored to your specific goals.

OIF strongly believes in the power of transformative technological innovation.

We lead the industry in managing major infrastructure projects across the MENA region.

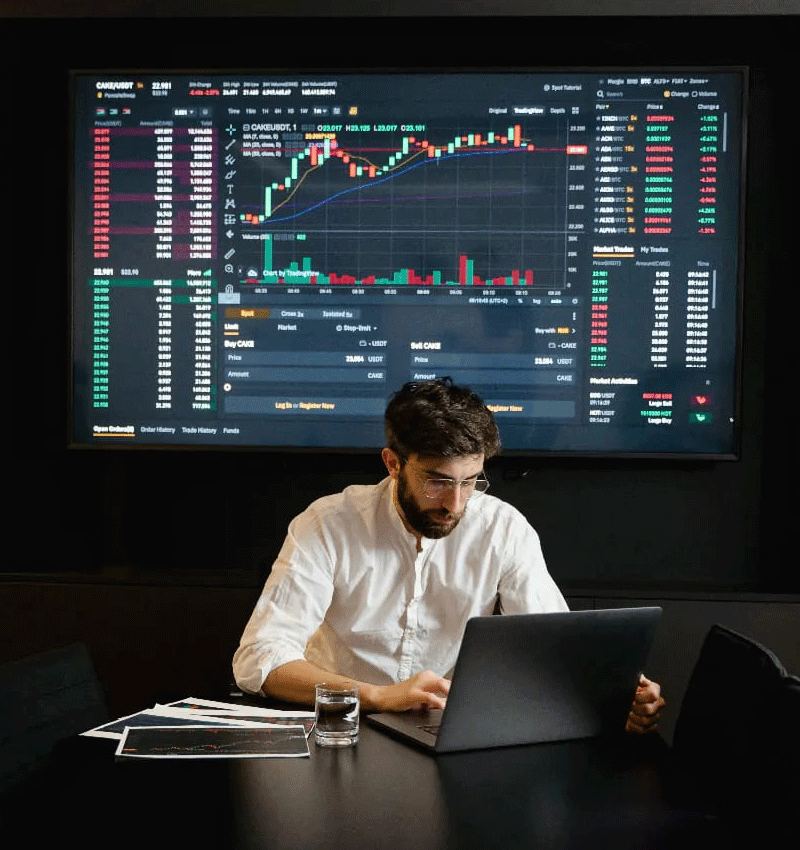

Investment & Risk Methodology

Before we start, we must understand your investment goals, time horizons, and risk tolerance. Once these factors are clear, we can create an investment policy to guide and manage your portfolio(s).

It’s crucial that you fully understand and agree to the investment guidelines OIF will follow in managing your portfolio. The details of your portfolio and our management plan will be outlined in a personalized Investment Policy Statement.

OIF will track your portfolio's performance using proprietary benchmarks based on major market indexes. Our selective rebalancing ensures portfolio integrity while managing trading costs.

Research articles are updated every week.

Are you ready to work with us? Let's grow your business.

Fill out the form and we’ll be in touch soon!